Operations

Nigeria Deepwater

Africa Oil Corp. has acquired a 50% ownership interest in Petrobras Oil and Gas B.V. ("POGBV"). BTG Pactual E&P B.V. owns the remaining 50% of POGBV.

Total cash payment by AOI, including the Nigerian Government’s consent fee, amounts to $519.5 million. This includes a deferred payment of $24.8 million which is due by end of June 2020

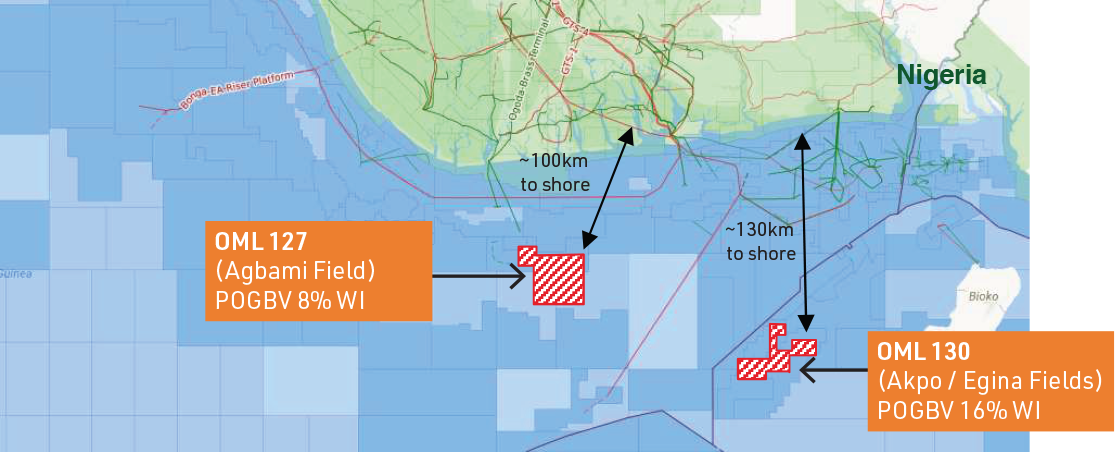

The primary assets of POGBV are an indirect 8% interest in Oil Mining Lease ("OML") 127 and an indirect 16% interest in OML 130. OML 127 is operated by affiliates of Chevron Corporation ("Chevron") and contains the producing Agbami Field. OML 130 is operated by affiliates of TOTAL S.A. ("TOTAL") and contains the producing Akpo and Egina Fields.

Aggregate gross field production from these assets averaged approximately 442,000 barrels of oil per day ("bopd")1 for the period January 1st to December 29th, 2019. Average daily entitlement production2 net to AOI's 50% shareholding in POGBV for the same period, was approximately 33,630 bopd. This compares to a January 2019 average net entitlement production of 22,460 bopd, with growth over the course of 2019 being mostly due to the production ramp-up on the Egina field, which came onstream in late December 2018.

A Transformative Transaction

Africa Oil has become a full-cycle E&P company with material reserves and production, strong operating netbacks, and free cash flow generation that is supported by an active oil price hedging program at the POGBV level.

Key highlights 3, 4, 5

- A transformational transaction as Africa Oil becomes a full-cycle E&P company with material reserves and production, strong operating netbacks, and free cash flow generation that is supported by an active oil price hedging program at the POGBV level;

- Year-end 2018 net entitlement proved reserves ("1P") of 62.7 million barrels of oil equivalent ("MMboe") and proved plus probable reserves ("2P") of 94.7 MMboe, net to AOI’s 50% shareholding in POGBV, with more than 90% comprised of light and medium oil;

- Based on the year-end 2018 entitlement reserves and LR’s 2019 production estimates, pro-forma (as of December 31st, 2019) entitlement 1P reserves of 49.2 MMboe (95% liquids) and 2P reserves of 80.6 MMboe (93% liquids) net to AOI’s 50% interest in POGBV;

- These reserves are for the three producing fields only and don’t account for undeveloped discoveries in the licenses;

- 2019 average operating cost estimate6 of $7.0 /boe;

- 2019 average operating netback estimate7 of $50.1 /boe; and

- Total cash payment of $519.5 million is funded from cash on hand and a loan for $250 million ("Loan") provided by Banco BTG Pactual S.A.;

- A deferred payment of $123 million, subject to update, may be due to the seller depending on the date and ultimate OML 127 tract participation in the Agbami field5; and

- POGBV has an existing reserve-based lending facility, with a syndicate of international banks with a drawn amount of $1.825 billion.

Asset Highlights

Nigeria Deepwater is comprised of three fields in these two licenses are all giant deep-water fields, located over 100 km offshore Nigeria, and are some of the largest and highest quality in Africa. All three fields have high quality reservoirs and produce light, sweet crude oil.

Agbami Field

In production since 2009

Akpo Field

In production since 2009

Total-operated Egina FPSO Field

Started production in December 2018 and ramped up to plateau production of approximately 200,000 barrels of oil per day during the first half of 2019.

In addition to the current producing reservoirs there are additional growth opportunities in undeveloped horizons within existing fields; adjacent undeveloped discoveries; and identified exploration targets within the licenses that are under consideration for development and exploration drilling. One advanced opportunity is the Preowei oil discovery, which is being considered as a satellite tie-back to the Egina FPSO. In the first half of 2019 the Field Development Plan for the Preowei field within OML 130 was approved by the Government of Nigeria. Preowei is not currently included in the Company’s reserves estimates.

Advisory Regarding Oil and Gas Information

The term MMboe (millions of barrels of oil equivalent) is used in this website. Such term may be misleading, particularly if used in isolation. The conversion ratio of six thousand cubic feet per barrel (6 Mcf:1 Bbl) of natural gas to barrels of oil equivalent and the conversion ratio of 1 barrel per six thousand cubic feet (1 Bbl:6 Mcf) of barrels of oil to natural gas equivalent is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different from the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value.

The reserves estimates presented on this website with respect to the Nigeria Acquisition have been evaluated by Lloyd’s Register ("LR") in accordance with NI 51-101 and the COGE Handbook, are effective December 31, 2018. The reserves presented herein have been categorized accordance with the reserves and resource definitions as set out in the COGE Handbook. The estimates of reserves in this press release may not reflect the same confidence level as estimates of reserves for all properties, due to the effects of aggregation.

Reserves are estimated remaining quantities of petroleum anticipated to be recoverable from known accumulations, as of a given date, based on the analysis of drilling, geological, geophysical, and engineering data; the use of established technology; and specified economic conditions, which are generally accepted as being reasonable. Reserves are further classified according to the level of certainty associated with the estimates and may be sub-classified based on development and production status. Proved Reserves (1P) are those quantities of petroleum, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs and under existing economic conditions, operating methods and government regulations. Probable Reserves (2P) are those additional quantities of petroleum that are less certain to be recovered than Proved Reserves, but which, together with Proved Reserves, are as likely as not to be recovered. Possible Reserves (3P) are those additional reserves that are less certain to be recovered than probable reserves. It is unlikely that actual remaining quantities recovered will exceed the sum of the estimated proved plus probable plus possible reserves.

- Production relates to aggregate full field production and in case of Agbami, it is in respect of OML 127 and OML 128. The Agbami Field spans OML 127 and OML 128 and is subject to a unitization agreement, with 62.4619% of field production currently allocated to OML 127. Please refer to Note 5 for more details on the Agbami tract participation

- Net entitlement production for the Company is calculated using the economic interest methodology and include cost recovery oil, tax oil and profit oil. These are different from working interest production that are calculated based on project volumes multiplied by the Company's effective indirect working interest

- Net reserves are based on an independent reserves evaluation, effective 31st December 2018, prepared by Lloyd's Register ("LR") for Africa Oil in accordance with Canadian National Instrument 51-101 – Standards for Oil and Gas Activities ("NI 51-101") and the Canadian Oil and Gas Evaluation Handbook ("COGE Handbook") for POGBV's net interest in OML 127 and OML 130 (the "LR Report")

- Pro forma (effective 31st December 2019) net entitlement reserves are based on LR's 2018 year-end reserves estimates less LR's forecasts of 2019 net entitlement production. These have been reviewed by LR, a Qualified Reserves Evaluator as defined in NI 51-101. These estimates do not represent audited reserves and the company expects to provide its NI 51-101 effective 31st December 2019 by the end of the first quarter in 2020.

- The reserves estimates are based on the original OML 127 tract participation of 62.4619% in the Agbami field with OML 128 having a tract participation of 37.5381%. This field is subject a tract participation redetermination that could see a higher interest (expected to increase to 72.064%) in favour of the OML 127 partners including POGBV; this is subject to Nigerian government's approval. Also, the reserves estimates don't account for the OML 130 discoveries, Preowei and Egina South, that are candidates for subsea tie-back developments to the Egina FPSO. The Company expects to provide its NI 51-101 F1 reserves report (effective 31st December 2019) by end of the first quarter in 2020 to account for: potential progress on the Agbami redetermination process; 2019 actual production for OML 127 and OML 130; a potential technical revision of Agbami's reserves; and a potential reserves addition for the Preowei project, which benefits from a government approved field development plan

- Based on LR's 2019 production and cost forecasts using the 2P profile

- Based on the LR Report. Operating netbacks calculated as oil sales net of operating expenses. Operating netback is a non-IFRS measure and does not have a standardized meaning under generally accepted accounting principles. Investors are cautioned that this measure should not be construed as an alternative to net income or other measures of financial performance as determined in accordance with IFRS. The Company's method of calculating this measure may be different to similar measures used by other companies. The company's management believes that operating netback is a useful supplemental measure for management and investors to analyse operating performance and provide an indication of the results generated by our principal business activities prior to the consideration of other income and expenses